All Mortgage loans, no matter what they are, have some type of mortgage insurance. FHA Loans call it MIP, loans for Veterans call it a Guarantee Fee and USDA Loans have a monthly and Upfront fee also called a Guarantee fee. For these government programs, the Mortgage Insurance stays in place for the life of the loan. Meaning, if you live in your house for 9 years, and you now have 20% equity, you still pay for the Mortgage Insurance. The main difference in programs is that Fannie Mae and Freddie Mac provide a means of removing PMI on Conventional Loans.

What is PMI insurance?

The main benefit of Mortgage Insurance is protection for the lender. Private Mortgage Insurance, or PMI, is required on all traditional conventional mortgage loans where the borrower puts less than 20% down.

If a home is foreclosed on, the bank is much more likely to “break even” on the sale of the property if there is at least 20% equity in the home. However, we understand that not every borrower is able or desires to empty their wallet on a down payment, and this is why traditional Conventional Mortgages are offered with as low as 3% down payment.

In those cases where a home is foreclosed on, and equity is less than 20%, the lender files a claim with the mortgage insurance company for a portion of the difference – the portion that is covered with PMI. Normally that’s between 18% and 35%.

When was private mortgage insurance created?

After the Great Depression, many Banks stopped making mortgage loans. In an attempt to fill the void and encourage shell-shocked lenders to make mortgage loans, the Federal Government in 1934 created FHA. At the outset, FHA hardly made a dent because lenders did not trust it. Fannie Mae was chartered in 1938 to buy FHA mortgages — to demonstrate that they were safe.

So, FHA was really the first entity to show that a business model could work for Mortgage Insurance. In the late 1950’s MGIC was formed as the first Private Mortgage Insurance Company. Unlike many mortgage insurers who collapsed during the Depression, MGIC would only insure the first 20 percent of loss on a defaulted mortgage. So, the Bank was covered for 20% of the mortgage, leaving them with risk on the other 80%, just like they would be if a borrower made a 20% down payment. This limited its exposure and created more incentives for savings and loan associations to issue loans only to home buyers who could afford them.

The guarantee was enough to encourage lenders across the country to issue mortgage loans to buyers whose down payments were less than 20 percent of the home’s price. The Homeowners Protection Act of 1998 came into effect as a federal law of the United States, which requires automatic termination of mortgage insurance in certain cases for homeowners when the loan-to-value on the home reaches 78%.

How do you avoid paying PMI?

Some Conventional Loans are available with no PMI requirements, even if you don’t make a 20% down payment. These loans will be “self insured” which means your mortgage interest rate will be substantially higher – and they could have other unusual features, meaning they might have adjustable rates. Be careful before choosing these types of mortgages and talk with a tax adviser before doing so.

Lender Paid Mortgage Insurance

Some lenders will pick up the cost of PMI. Instead of PMI, the lender charges a higher mortgage rate than the buyer putting 20 percent down. Depending on the lender paid PMI option, the payment could be lower than with buyer paid PMI, and the larger amount of interest paid is tax-deductible. Mortgage Insurance (including PMI) is deductible on taxes as well. According to H&R Block:

Once your adjusted gross income (AGI) exceeds $100,000 ($50,000 for married filing separately) the deduction is reduced.

The mortgage insurance deduction is eliminated once your AGI surpasses $109,000 ($54,500 if married filing separately).

Can you get PMI waived?

The SECU in NC routinely offers programs with no PMI, however they do not offer fixed rate mortgages. With today’s rates well below 5%, most people do not want to gamble with a rate that will likely go higher in 2 years.

Another option is to put 10% down on your home, and get a HELOC (2nd mortgage, Equity Line) for the additional 10%. These are generally adjustable loans, and often have interest only payments required. Many people in the mortgage business call them 80-10-10s, and for many years after the “Fall out” from the Mortgage Debacle. However, in the past 12 months, we have many several of these loans, and it does make the payment lower! You can always refinance out of the 2nd mortgage once you have the 20% equity in the house.

PMI Mortgage Insurance Tiers

We are one of the Top Lenders for NCHFA in NC. As with all approved lenders, we routinely offer their mortgage rates and programs because they have the lowest PMI factors in the State. This is a HUGE benefit, especially if your credit scores are under 720, as the risk factors for PMI are at the 18% coverage, 25% coverage and 35% coverage rates. The higher the risk for the PMI Companies, the lower the credit score, the lower the down payment… the higher the PMI rate.

I just calculated a PMI for a 95% loan of $250,000 with a 720 credit score, and I got a monthly PMI payment of $85.42. So that’s with 5% down. On a FHA Loan the payment would be $166 a month. You can get a rough estimate of your PMI Payments here.

Why Use A Conventional Mortgage Loan?

Because of Student Loan Debt, the Conventional Loan is the ONLY obvious choice for anyone who is not a Veteran. Veteran’s have great choices, but the rest of us? Not so much.

Currently, if you want to buy a house and you have Student Loans that are still in deferment, and you are making no payments, your only loan option is a VA Home Loan. With this program, you must be a qualifying Veteran, or part of that household. If the Veteran is buying a house with student loans, those loans will need to be in deferment for 12 months PAST the closing. This is difficult to negotiate, but it can be done.

The “non-Veteran” folks who are buying a house with student loans that are making IBR payments really only have one option too. If you have student loan debt, and the payment is showing on the credit report, we can make you a Conventional Loan, with 3% or 5% down. The 3% option does have some maximum income caps associated with it.

Here’s the good news about this program. Fannie Mae and Freddie now allow us to take exactly the payment showing on the credit report. The credit report can not say for instance, payments beginning in November when it’s August.

You can also do a cashout refinance, and get out of a FHA Loan (where you can’t cancel PMI EVER) and go into a Conventional Loan, where the PMI can be cancelled!

Removing PMI on Conventional Loans

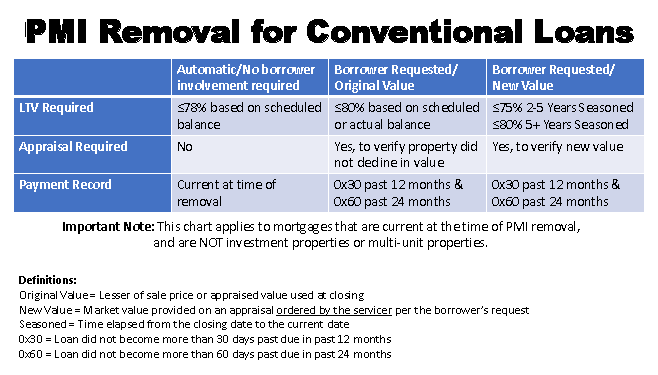

- Automatic – Occurs when a borrower hits 78% LTV of the scheduled amortization. Cannot be used if borrower pays down balance to get to 78% faster than scheduled.

- Borrower requested (original value) – Most often occurs when a borrower pays down a balance faster than scheduled and requests PMI to be removed based on the value used at closing.

- Borrower requested (new value) – Occurs when a borrower requests PMI removal based on a new appraised value, and the loan has been open for at least two years.

Here are additional information about requirements that may or may not be required when a Homeowner is removing PMI on Conventional Loans.

The Homeowner should always consult their Servicer before taking any action, including ordering an appraisal. In most cases, the Servicer will need to order the appraisal themselves or they could have additional overlays/restrictions for removing PMI on Conventional Loans.

If you have questions about Removing PMI on Conventional Loans, and weather a Conventional Loan is the right loan for you – please call Steve and Eleanor Thorne, 919 649 5058. We work with many first time hm ebuyers, and those who are just looking for the best mortgage rates!

Great information. Does NC law allow for a BPO when the borrower requests to drop PMI based on appreciated value, or is an appraisal necessary? Does the borrower initiate the process independently, or do you start by contacting the lender? Thank you!

You start by contacting whoever is servicing your account. Normally you have to make at least 24 months worth of payments before they will consider it, sometimes it is a little shorter. If your account is under Fannie Mae, then it will definitley be 2 years, if not then you might not have to wait that long.

Thank you so much!