Do you really want to get out of that apartment? Did you know that NOW is that time you can make a KILLING buying real estate and DUMP your roommates?? Nontraditional Credit might be a way to do this faster if you don’t have a credit score!

Do you really want to get out of that apartment? Did you know that NOW is that time you can make a KILLING buying real estate and DUMP your roommates?? Nontraditional Credit might be a way to do this faster if you don’t have a credit score!

If you’re ready to take the next move – and you don’t have three good lines of credit established – GREAT NEWS!

The new Housing Bill requires that Fannie and Freddie begin accepting NTMCR’s next year! Hugh? Non Traditional Mortgage Credit Report… The report is to be “designed to assess the credit history of the borrower without the benefit of institutional trade references and should format as traditional references – including creditor’s name, date of opening, high credit, current status of the account… payment history. It should not include subjective statements like ‘satisfactory or acceptable.”

In other words, most of us have insurance we pay, cell phone bills, Netflix – Nontraditional Credit can be used to build a credit score.

That’s cool – but it’s not in effect for all mortgage programs yet! This means that if you have limited credit experience, or you don’t have at least 3 trade lines, you need to get an FHA loan. In Wake County, the FHA limit is $318,550, and as of October 1, 2019, the minimum downpayment for this program is 3.5%.

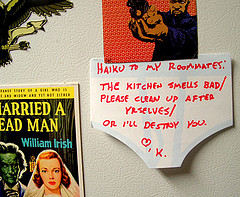

So don’t continue to put up with stinky roommates! Break out! Buy a house while prices are low – and you get a $8000 mortgage grant for the down payment!

If you are purchasing a home in Garner, or buying a home in Raleigh/Cary, please call Steve and Eleanor Thorne, 919-649-5058 we know how to help you use Nontraditional Credit to buy a house!

This is solid information that answered my question.